Last week I wrote about the problems facing American farmers due to the Trump administration’s destructive economic policies. If all those weren’t bad enough, he next gave $20 billion to Argentina to help pump up their economy. That did not sit well with farmers, because the results were even more destructive to them.

Don’t Cry for Us, Argentina

China stopped buying U.S. soybeans due to Trump’s trade war and tariffs, which made American soybeans more expensive.The bailout gave Argentina access to U.S. dollars via a currency swap and direct peso purchases, stabilizing their economy just as they ramped up agricultural exports. Argentina, a major agricultural competitor, then sold millions of metric tons of soybeans to China—20 shiploads in just two days following the bailout announcement.

Argentina next waived export taxes on soybeans sold to China, making their crop even more competitive globally. This undercut American farmers, who were already struggling with high input costs and retaliatory tariffs.

The Farmers React

Farmers felt betrayed by the administration’s “America First” promise, seeing the bailout as a contradiction of that promise. Both farmers and lawmakers criticized the bailout as favoring a foreign competitor while delaying domestic farm aid amid a government shutdown.

The American Soybean Association and senators from both parties argued that the bailout prioritized Trump’s political ally over U.S. agricultural interests.Senator Chuck Grassley (R-Iowa) asked why the U.S. would help Argentina “while they take American soybean producers’ biggest market.”

Why, indeed?

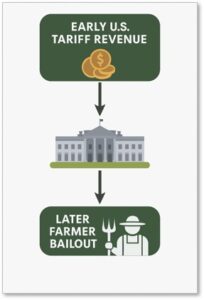

In response, the president declared that he would give a relief package to the farmers using money taken from tariffs that have already been paid. Some of those taxes were paid by the farmers themselves. That sounded suspiciously like a Ponzi Scheme to me, only in reverse.

What Is a Ponzi Scheme?

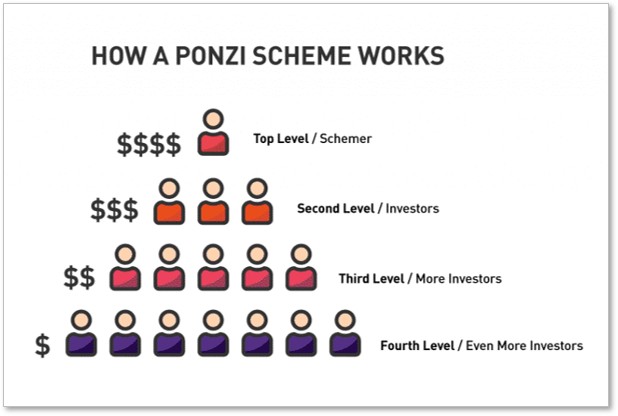

A Ponzi scheme is a fraudulent investment scheme where returns to earlier investors are paid using the capital invested by newer investors, rather than from profits earned by operating a legitimate business. This scam relies on a continuous influx of money from new investors to keep going. It typically collapses when it becomes difficult to recruit new participants or when many investors try to cash out simultaneously and the flow of new investment money dries up.

A Ponzi scheme is a fraudulent investment scheme where returns to earlier investors are paid using the capital invested by newer investors, rather than from profits earned by operating a legitimate business. This scam relies on a continuous influx of money from new investors to keep going. It typically collapses when it becomes difficult to recruit new participants or when many investors try to cash out simultaneously and the flow of new investment money dries up.

Then the perpetrator either scarpers off with the ill-gotten gains or goes to prison. In the cases of both Carlo Ponzi, who invented the scheme, and Bernie Madoff, who used it on Wall Street, the result was prison.

Tariff Revenue as Farm Subsidy:

Tariff Revenue as Farm Subsidy:

Now, using tariff revenue to fund subsidies for farmers is neither illegal nor fraudulent. But it can resemble a circular loop; one that eventually becomes unsustainable. Here’s how that works:

- Tariffs raise prices on imported goods. U.S. consumers and businesses pay the import taxes.

- Foreign retaliation, as we have seen, reduces demand for U.S. farm exports.

- Farmers suffer, so the government uses the tariff revenue to bail them out.

- Consumers pay twice: once via higher prices, and again via taxes or debt-financed subsidies.

The tariff subsidy reverses the Ponzi Scheme model by using early money to bail out people who find themselves in financial trouble later on. In reality, though, a reverse Ponzi Scheme is still a scam and just as unsustainable.

Why It Feels Like a Ponzi Scheme

Trump’s farm bailout feels like a Ponzi Scheme for several important reasons.

- It creates no new value: The system redistributes pain rather than solving the underlying problem caused by tariffs and a trade imbalance.

- Dependent on continuous inflows: If tariff revenue drops (e.g., due to imports falling or a tariff war), the subsidy funding dries up.

- Short-term patch, long-term risk: By providing immediate but short-term relief, It masks structural damage to export markets and labor supply

What do Economic Analysts Think?

Many economists argue this model is politically expedient but economically inefficient because it:

- Distorts market signals, encouraging overproduction.

- Delays adaptation, preventing farmers from shifting to new crops or markets.

- Drives farmers out of business in the long run.

- Risks backlash if subsidies are seen as unfair or misallocated.

I think that last point is particularly important. One can easily see this redistribution of tax revenue as socialism, something the Republican right claims to hate but has no problem with as long as it’s helping them. After all, it involves moving money paid as tariffs by people across a wide variety of industries and giving it to people in a single industry—farming.

Although not classic socialism, however, it can more accurately termed market redistribution.

The Reverse Ponzi Scheme’s Bottom Line

Although I can’t define Trump’s subsidies as a classic Ponzi scheme in the legal or financial sense—it is a closed-loop system with diminishing returns. Thus, it can create the illusion of support while eroding long-term resilience. In the short run, it makes farmers feel good about Trump and the Republicans while disguising what will happen when the money runs out.

As Aldonza says in “Man of La Mancha,” “Whether the stone hits the pitcher or the pitcher hits the stone, it’s going to be bad for the pitcher.” Whether reverse Ponzi Scheme, socialism, or something completely different, this administration’s policies are bad for the farmers. They have begun to realize that and understand that they’re being played.

The question is what they will do next.