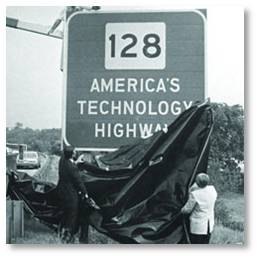

A recent article by Li Zhou in @PolicyMic entitled “7 Reasons Boston is Poised to Become Tech Capital of the World,” has a lot of good things to say about the city’s possible resurgence in innovation. Once America’s true technology capital, Boston has slipped to #6 on Startup Genome’s 2012 ranking of the world’s best region for startups. This is a sad development for those of us who remember the region’s glory days when Route 128 was “America’s Technology Highway.”

The Original Tech Anchors

Ms. Zhou’s Reason #5 is that “Giant companies are expected to rise up to become Boston’s ‘tech anchor’ in coming years.” Sounds good to me. Back in the day, we had those monoliths—lots of them. Here’s a partial list in alphabetical order of the big corporations—and big employers—that once had headquarters in the Greater Boston area but have since gone out of business or been acquired.

Computervision

Computervision- Data General

- Digital Equipment

- Polaroid

- Prime Computer

- RSA Security

- Sun Microsystems

- Wang Laboratories

What happened to those innovators, market makers and employment anchors? Well, four of them missed the move from mini-computers to workstations and then to PCs and laptops. Committed to defending their existing product lines, they went into serious denial when confronted by a shift in product model that changid demand. Like giant trees, they toppled to the floor of the tech rainforest to become “nurse logs.” The money and talent from their executive teams provided fertile ground in which new startups could sink their roots .

Some were undone by disruptive technology technologies, as when Polaroid was killed by the digital camera. And some, like Wang Laboratories, succumbed to multiple layers of bad management decisions, overblown executive egos, and a mistaken sense of invincibility. The lucky ones were acquired by bigger companies, mostly on the West Coast. The rest quietly decomposed on the forest floor while their employees scurried amid the detritus, searching in vain for new jobs.

What Happened, Boston?

In October of last year, Hamish McKenzie in @PandoDaily asked the question, “What happened, Boston? The original startup hub is in search of its mojo.” Well, one of the things that happened was a resurgence of what I wrote about in last year’s post: “Does a Century-old Attitude Still Influence Boston in 2013?” This locally bred “stout conservatism” looked askance at anything totally new and groundbreaking. It demanded a level of organization and business acumen that many new–and typically young–entrepreneurs lack.

The established VC Community of the day simply could not see outside the box. It’s ironic when a business founded on risk becomes risk averse and will bet only on a sure thing. That generation of Boston VCs was particularly blind when it came to Business-to-Consumer (B2C) business models. After all, the big anchor companies listed above—with the sole exception of Polaroid—sold “big iron” or enterprise software products to other companies. And if you had vision but no solid business model, they would show you the door.

The would-be entrepreneurs who went out that door kept going all the way to Silicon Valley, where they were welcomed and encouraged. Not only did they get their seed money, they were pushed to think big, to take big risks and to plan for greatness. What a concept!

The startups that could take root in that nurse log on Boston’s rainforest floor also had very limited goals, Unlike small firms in Silicon Valley, most of them didn’t think about or plan to become a big company with a headquarters building, the best engineers, a large cadre of employees and a foosball machine in the break room. Instead, their exit strategy was to be acquired by a bigger company. I do not sneer at this model, mind you. My options in Guardium and Q1 Labs, both acquired by IBM, helped us into a comfortable retirement.

And, to be fair, this goal seemed to be a reasonable reaction to the Sarbanes-Oxley Act. Knowing that a new company’s first year’s revenues after an Initial Public Offering (IPO) could be spent just on complying with “SarBox” put the kibosh on a lot of big thinking and transformed many potential IPOs into M&As. But this exit strategy does not grow the kind of monolithic anchor corporations that help a city become #1 in innovation.

Changing in a Big Way

So I’m delighted to hear that things are changing—and changing in a big way. Startups in software, media, consumer, security, ad-tech and Big Data are not only thriving, they are moving from the stodgy suburbs into Boston’s Innovation District. Located down in the newly developing Seaport area, this district is beginning to look more like South Beach on a Saturday night than the grungy fish piers of old. Cambridge’s Kendall Square is another hotbed of innovative startups, mostly in the biotech industry.

Even the big West Coast companies have seen enough value in the Boston area that they have built up their corporate presences here. IBM, Cisco, Google, and Microsoft—among others—have set up shop to take advantage of the area’s highly educated and talented workforce and a much more reasonable cost of living (well, compared to Silicon Valley).

So much has changed in Boston lately that the venture capital companies are moving their pampered butts from the heights of Waltham’s Winter Street above the reservoir to Cambridge and the Seaport. It’s going to be interesting to see what happens when all those black limos get stuck in city traffic. Access to Logan Airport via the Harbor Shuttle will be a lot faster, though, if not as comfortable.

Boston Strong? You bet. Not just in sports, or attitude, or number of colleges and universities, but in the kind of thinking that creates new industries and innovation that drives economies.

Way to go, Boston. Way to go!