Remember all those articles that get published every time a politician tries to raise the federal minimum wage? Reporters and editors dig up the same, old, shopworn arguments against it.

Remember all those articles that get published every time a politician tries to raise the federal minimum wage? Reporters and editors dig up the same, old, shopworn arguments against it.

To believe them, you have to accept that increasing the minimum wage is tantamount to destroying the American economy.

The Zombie Myths

A year ago, The Hill offered these six dire consequences in “Six reasons to oppose a $15 federal minimum wage.”

A year ago, The Hill offered these six dire consequences in “Six reasons to oppose a $15 federal minimum wage.”

- The trade-offs aren’t worth it.

- It won’t help those in poverty.

- It is unlikely to raise wages for the lowest-paid workers

- It eliminates entry-level jobs

- It will raise prices for those who can afford it the least.

- It gets rid of key protections for workers.

Other gloomy predictions include:

- It will force employers to replace workers with automation

- Employers will increase demands that customers provide free labor through kiosks, self-service, and self-checkout.

These zombie myths lurch into the light every time politicians propose raising the minimum wage.

Minimum Wage: Who Was Right?

Umm, Well. Guess what? We’re about to find out who was right and who wasn’t.

As Reporter Austen Hufford wrote in The Wall Street Journal on Saturday,

“More than half the states in the U.S. are set to lift their minimum wages in the coming year, but the effects could be muted because many low-income workers already earn more than mandated due to strong labor demand.”

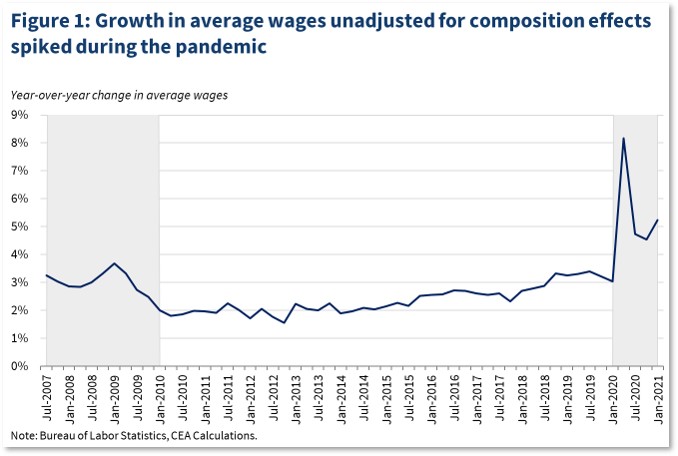

As we have seen, labor shortages resulting from the pandemic have forced employers to offer more to prospective employees and pay more to the ones they already have. The effect is most pronounced for low-wage workers, exactly the people critics have said would be injured by making more money.

Yet consumers are already coping with higher prices via inflation. What’s creating problems for many small businesses is a lack of workers, not higher wages. So, they are offering more money just to get people to work so they can keep their businesses open. Will that raise the prices of their goods? Tha’s happening already. But we have also seen those businesses not only stay open but prosper.

Which Dire Predictions Are Accurate?

Now, The Wall Street Journal is owned by Rupert Murdoch, one of America’s two most dangerous immigrants. He would be in favor or child labor and outright slavery if he could, because that would mean higher profit margins for business owners. So, it must have pained him to publish this article.

But the point is that we are about to discover whether all those dire predictions are accurate. And it will happen without politicians lifting a finger or taking a vote to raise the minimum wage.

But the point is that we are about to discover whether all those dire predictions are accurate. And it will happen without politicians lifting a finger or taking a vote to raise the minimum wage.

Will that be bad or good? The WSJ article quotes one man who works in the restaurant industry as saying he plans to use the increased salary to pay for braces for one of his kids. That sounds like a good thing to me.

Ongoing Automation

As for automation, that’s been happening for years. I have written before about businesses demanding that their customers perform the work formerly done by employees. Minimum wage had nothing to do with this process. It can’t have, because the federal minimum wage hasn’t gone up since July of 2009 but automation has increased significantly in the meantime. That means we customers all work for the companies we buy from, only for free. Now there’s a profit margin to put a twinkle in Rupert Murdoch’s eye.

Will inflation get worse because workers are making more? Will poverty shrink? Those answers remain to be seen.

The Inflation Outlier

The outlier in this analysis is the Federal Reserve. Chairman Jerome Powell has stated his will increase the interest rate until wages start coming down. That means he intends to balance out the economy on the backs of American workers. It’s the economic equivalent of saying the lashings will continue until morale improves.

Keep in mind that, accounting for inflation, wages have actually fallen over the past 17 months. So, inflation has already effectively lowered wages for the American worker. It currently takes more money just to stay even – and most people don’t have it.

Keep in mind that, accounting for inflation, wages have actually fallen over the past 17 months. So, inflation has already effectively lowered wages for the American worker. It currently takes more money just to stay even – and most people don’t have it.

Still, the Fed plans to pile on until people stop buying houses and setting up households, buying new cars, taking vacations, purchasing athletic gear, joining health clubs, getting tattoos, buying the latest cell phone, and making any other discretionary purchases.

Predicting a Recession

Also, remember that many companies have raised prices so they can: (A) pay more dividends to shareholders, (B) buy back their own stocks, (C) pay their CEO more when he already makes (1,000 times more than he pays their median employee), (D) all of the above. Chairman Powell has not shown any interest in those inflation drivers. No, he just wants to sock it to workers.

Now he, and the other economic geniuses who tinker with the American economy are predicting a recession in 2023. Well, duh. If you drive the economy into the ground, what else do you expect?

The Smartest Guys in the Room

Now, these are supposedly the smartest guys in the room. Just ask them; they’ll confirm it. They’re so smart, of course, that they will dump all the pain of cutting inflation onto other people. Not them. Never them.

Now, these are supposedly the smartest guys in the room. Just ask them; they’ll confirm it. They’re so smart, of course, that they will dump all the pain of cutting inflation onto other people. Not them. Never them.

The people who have never filed for unemployment, had to worry about making a mortgage payment, struggled to pay COBRA, tried to afford both food and medicine, or watched their kids go without braces or medical care plan to inflict those damages on others. And they will pat themselves on the back as they do so.

But you know what they say about economics: “It works in practice but will it work in theory?” With wages exceeding the minimum wage, we’re about to find out.