Monday Author: Susanne Skinner

Nothing prepares us for sudden and unexpected death. The loss of a spouse or partner is life altering. When it happens, the world stops and everything changes. A team of two is now a team of one, challenged to manage the minutia of life’s deadlines and responsibilities.

Nothing prepares us for sudden and unexpected death. The loss of a spouse or partner is life altering. When it happens, the world stops and everything changes. A team of two is now a team of one, challenged to manage the minutia of life’s deadlines and responsibilities.

When the unthinkable happens, time-sensitive items get delayed or overlooked. Upfront planning is the ounce of prevention that offsets the pound of cure. A seemingly trivial thing like an automobile insurance policy grinds everything to a halt.

This blog is inspired by real-life observations and examples. Today is the perfect time to create a checklist to navigate the aftermath of loss. Estate planning does not always include this level of detail.

Planning reduces the risks. Create a surviving spouse check list—you’ll be surprised by what you do not know. If you are single, appoint a trustee to act on your behalf and share your list with them.

The Paralysis of Grief

Missed due dates create risks. Emotion overtakes logic and the cadence of daily life stalls, making it easy to forget important details. Grief is our heart’s response to loss, leaving room for little else but the pain of that loss.

Sudden loss manifests itself in grief paralysis. Grieving compounds the inability to bring closure to unresolved conflicts, express love and forgiveness, or say goodbye. When a young person passes unexpectedly grief is magnified by a life unfairly cut short. Emotional and physical inertia are common side effects.

It’s easy to forget a cell phone bill or overlook a library return. But the long-term effects of unpaid bills, account closings and unprocessed paperwork leads to loss of services and financial stress.

Proactive Preparation

We don’t sit around planning for death because it’s counterintuitive to living our best life. But it’s exactly what we should do because one is necessary for the other. Our best life depends on creating a central location for personal and financial information to share with loved ones.

Life is made up of services critical to our everyday well-being. A driver’s license, auto insurance, and health-care policies renew on a regular schedule. A lapse in any of them is devastating.

Life is made up of services critical to our everyday well-being. A driver’s license, auto insurance, and health-care policies renew on a regular schedule. A lapse in any of them is devastating.

A U.S. passport is good for ten years but most international destinations refuse entrance to U.S. travelers unless their passports have at least six months of validity. A quick check allows you to apply for renewal well in advance of planned travel.

Setting up reminders now pays dividends later. Double check your documents, create a due-date calendar and enter reminders in your computer.

Life Goes On

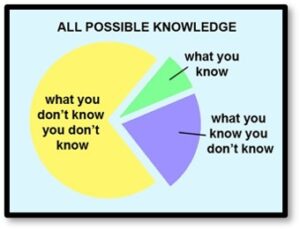

This is not an insensitive statement, it’s a realistic one. Amid sadness and grief, life goes on. Knowing what to do, who to call and keeping things current is vital. But sometimes, we don’t know what we don’t know. Don’t be afraid to ask for help.

A good estate-planning attorney or CPA is worth the upfront investment. They provide invaluable guidance when establishing trusts, legal documents and medical directives. Remember—every state is different. If you recently moved, update your documents to reflect the laws of your current state.

A good estate-planning attorney or CPA is worth the upfront investment. They provide invaluable guidance when establishing trusts, legal documents and medical directives. Remember—every state is different. If you recently moved, update your documents to reflect the laws of your current state.

Life insurance benefits require immediate action. Call your spouse’s life insurance company to claim benefits and change beneficiaries in any policies that listed your spouse as the first beneficiary.

Equally important are pensions. There are two types of defined pension benefit plans: single life benefit and joint and survivor benefit.

Single life benefits consist of monthly payments based on your spouse’s lifetime. Joint and survivor benefit plans provide a monthly payment based on the surviving spouse’s lifetime. You receive your spouse’s pension when the joint and survivor benefit option is chosen

When a Spouse or Partner Dies: Checklist

- Delete or memorialize social media accounts

- Close or forward email accounts

- Contact family and friends

- Review/update funeral directives

- Check U.S. Military Veteran status

- Order at least 10 certified copies of the death certificate

- Secure all personal property belonging to your spouse.

- Notify social security

- Stop health insurance coverage

- Notify life insurance companies and file claims.

- List all bills and due dates

- Contact financial advisors for beneficiary information.

- Notify mortgage and credit card companies and banks

- Contact a tax preparer for estate tax guidance

- Close ALL accounts that are only in your spouse’s name.

- Take your spouse’s name off joint cards and accounts.

- Notify credit reporting agencies

- Change joint legal documents for existing assets into your name

Figuring Things Out

Make sure you know what to do, who to call, and how to get certain things done even while you’re coping with loss. Don’t overlook your network of friends and relatives. Lean on them and let them help you.

Make sure you know what to do, who to call, and how to get certain things done even while you’re coping with loss. Don’t overlook your network of friends and relatives. Lean on them and let them help you.

Settling affairs is not a one-person task. Seek assistance from professionals like lawyers or CPAs to advise you on financial matters.

It’s essential to remain in control of your finances and expenses going into the future. Prepare for that future now by providing the information needed to do the things you must do after your spouse or partner dies.

Resources

These links offer valuable information and resources. There is some overlap but they all present a methodical approach to doing what must be done.

- When A Spouse or Partner Unexpectedly Dies

- What To Do When A Loved One Dies

- National Institute on Aging: What To Do After Someone Dies

- Experian: Checklist When A Loved One Dies

- AARP: What To Do When Someone Dies

- Consumer Reports: What To do When A Loved One Dies

- Surviving Spouse Checklist

When someone you love dies, the job of handling personal and legal details is overwhelming. It takes at least a year to complete and it is a hard job.

Doing as much as you can up front is a gift to those doing this job. Starting a conversation about end-of-life planning with your loved one is the gift you give each other.

This is a tremendously helpful posting not only as preparation for sudden death of a spouse but for death of a spouse at any time. I am going to point my children and grandchildren to your lists.