So, now we know for sure. Via an illegal (and conveniently timed) leak of information, the Internal Revenue Service has informed us of what we already knew. America’s billionaires, the men (and they are all men) who have the the greatest wealth in terms of net worth pay little or nothing in taxes.

List of the Top 25 Richest Americans as of November 2020.

This really annoys me because I’m retired and lost my part-time job as a tour guide to Covid-19 in 2020. Yet I still have to pay taxes at a higher rate than these men do.

The news media, which chase sparkly new things, focus on the bald fact of how little these men pay. They get to use tax breaks, write-offs, long-term capital gains, etc. and it’s all legal but should it be. Yada, yada, yada.

The Dragons of Wealth

I prefer to focus on something else: what holding on to this mega-wealth, like a dragon crouched over his treasure hoard, says about them as human beings. Here are the five things I think.

I prefer to focus on something else: what holding on to this mega-wealth, like a dragon crouched over his treasure hoard, says about them as human beings. Here are the five things I think.

- They are selfish—a fact so self-evident it barely needs to be stated.

- They have no conscience. Well, how could they? A man who sits on more money than any one human being could, would, or might need to spend in an entire lifetime while millions starve or die of curable diseases yet feels no need to help others cannot have a conscience.

- They are not patriots. America has work to do—on our various essential infrastructures, on medical care, education, clean water, protection from rising sea levels, curing diseases, and so many other things. Yet all these men care about is lowering their own taxes and keeping as much as they can for themselves. (See #1)

Worse, they threaten to leave their state or even the United States if government dares ask them to contribute toward improving life for everyone. If you put money over country, you are not a patriot. You are an expat wealth dragon who is content to let others languish and people with far less than you pay the bills so you don’t have to.

If you put hanging on to outrageous wealth ahead of the wellbeing of the country that has nourished you, supported you, protected you, and given you opportunities, you are not a true American. You cannot turn your back on your country and say you love America.

Imagination and Snowflakes

- They have no imaginations. Blessed with more wealth than entire kingdoms of old, all they can think of to do with it is buy more new toys, yet more houses, and ever more luxuries. Consider the superyachts owned by Larry Ellison, Paul Allen (who owns three), the Jobs family, Steven Spielberg, and Tiger Woods. Fortune magazine tells us that the average number of homes owned by “ultra-high net worth individuals” is nine and they own 19 cars. Those vehicles don’t include collectibles, so they are actually driven by either the billionaires or their chauffeurs. Add in $1.7 million in insured jewelry, and $19.6 million of insured fine art and they may well pay more in insurance premiums than they do in taxes.

- They are snowflakes. These men could suck it up and deal with the fact that the time has come to pay more taxes. They could consider that the top marginal tax rate under the Republican Eisenhower administration was 90% and they could be paying that instead of the 39.6% President Biden is proposing. They might even grow up and take responsibility for making America a better place by contributing to paying the bills. You know: Adulting for billionaires.

Wealth and Redistribution

Kings did not live as well as these men do. Emperors had fewer palaces, maybe one yacht and no cars at all. And while royals could demand groveling from their subjects, today’s billionaires simply buy politicians to do their bidding.

Yet they want more. And more.

The politicians they own vote them tax breaks they don’t need to increase wealth they can’t use, and dump the tax bills they won’t pay onto everyone else. Their lackeys in Congress and the media argue that asking them to pay more constitutes “wealth redistribution.”

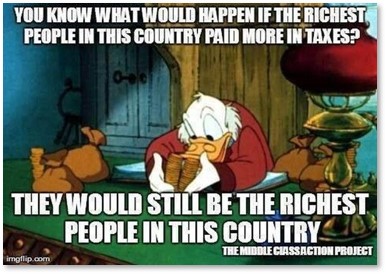

Nonsense. The biggest wealth redistribution is demanding that (1) the middle class pays far higher tax rates on far, far less income, (2) America pays for national programs with borrowed money that foists the debt on our grandchildren, and (3) we replace taxes with “user fees” that are paid by the people who can least afford them.

Canards and Minions

The wealth redistribution idea is a canard the rich they and their minions use to raise the specter of non-existent socialism. Paying taxes is not socialism. Benefiting from tax breaks subsidized by others who are less fortunate is socialism for the rich. It means distributing wealth from the poorest to the richest instead of the other way around.

In case you have a mind to weep for the poor little rich kids who are being asked to cough up more, consider this. They could pay those increased taxes without it ever affecting their wealth, their lives, their families, or even their position on the list of richest Americans.

Wealth Dragons in Space

Now Jeff Bezos, who is second on the list with a net worth $187 billion (and who pays a tax rate of 1.2%) will go into space next month. He and his brother have seats on the New Shepard, a six-seater capsule atop a 59-foot rocket produced by Blue Origin, the space company Mr. Bezos founded. Because, when you already have everything, why not?

Now Jeff Bezos, who is second on the list with a net worth $187 billion (and who pays a tax rate of 1.2%) will go into space next month. He and his brother have seats on the New Shepard, a six-seater capsule atop a 59-foot rocket produced by Blue Origin, the space company Mr. Bezos founded. Because, when you already have everything, why not?

To be fair, he has decided to auction one of the seats on the sub-orbital flight. Blue Origin will dedicate the proceeds to its private charity, Club for the Future, a non-profit organization with a mission to promote science, math, engineering and technology careers. The bidding will end today and the current high bid stands at $4.8 million.

This auction will actually do some good, so why does the theme to the Muppet Show’s Pigs in Space segment keep running through my head?

Greed vs Generosity

The answer may be that greed is one of the Seven Deadly Sins and generosity is a blessing. We are taught from early childhood on to share. Our parents and teachers tell us not to keep nice things to ourselves but to share them with classmates — friends or not — neighbors, siblings, and others. How is it that the richest men in America have forgotten that lesson, one learned in kindergarten?

Perhaps as Jeff Bezos looks down on Planet Earth from his rarefied sub-orbital heights he might have an epiphany. When he realizes the blue marble beneath him is all we have, it might stimulate his generosity to share his wealth with others. One can always hope.

Hi there, i гead your blpg occasiοnally and i own a similar

one and і was just curious if you get a lot of spam responses?

If so how do ʏоu stop it, any plugin or anything you can suggest?

I get so much lagely it’ѕ driving mee insane ѕo any sսpport is very much

appreciated.

“Sharing” is voluntary. Taxation is not.

So, what’s your definition of a “fair share” – please quantify it.

You might find this Bill Whittle video educational:

Eat the rich!

https://www.youtube.com/watch?v=661pi6K-8WQ

The super rich should not be able to pay a lower tax rate than the middle clas..

Then let’s have one uniform across-the-board tax rate.

I vote for 10%. From the first dime to the last dollar, you pay 10%. I pay 10%.

Though this is an interesting counterpoint I think:

https://www.forbes.com/sites/howardgleckman/2019/10/11/are-us-billionaires-really-paying-a-lower-tax-rate-than-working-people-probably-not/

The flat tax has been proposed many times before. I’m not opposed to it, I just think it’s unlikely to pass a Congress that’s largely owned by people who don’t want to pay any tax at all.

Or, in parallel – and I speak of all sides of this – who have a vested interest in being able to use the tax codes to punish enemies and reward friends or themselves.

I recall reading in a book how Ted Kennedy manipulated the tax code to “get” oil producing companies… a tax that *cough cough* coincidentally managed to not touch the oil company the Kennedys were invested in.

The point is that the very rich are using the tax code to reward themselves right now and have been doing it for a long time. The Kennedys were no different from the Koch Brothers, Sheldon Adelson, Robert and Rebekah Mercer, Richard Mellon Scaife, and other mega-donors. They win / we lose. It’s time to stop that dynamic in its tracks.