I watched the 60 Minutes interview with Jerome Powell, chairman of the Federal Reserve Bank with some consternation. There they sat, Chairman Powell and Scott Pelley, talking about inflation and interest rates without ever mentioning the elephant in the room.

Sure, inflation has dropped but that decrease hasn’t had any impact on supermarket prices. People go food shopping and walk out of the supermarket feeling ripped off because they got less and less food for more and more money.

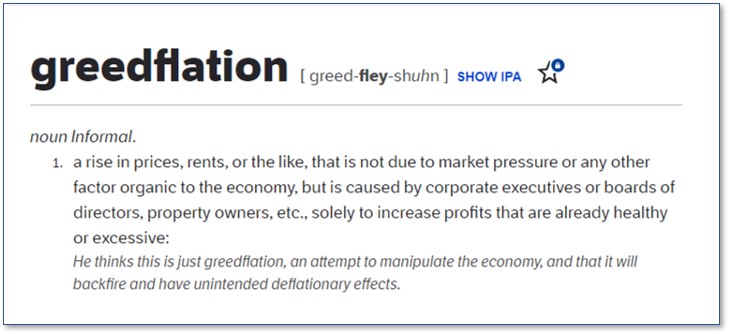

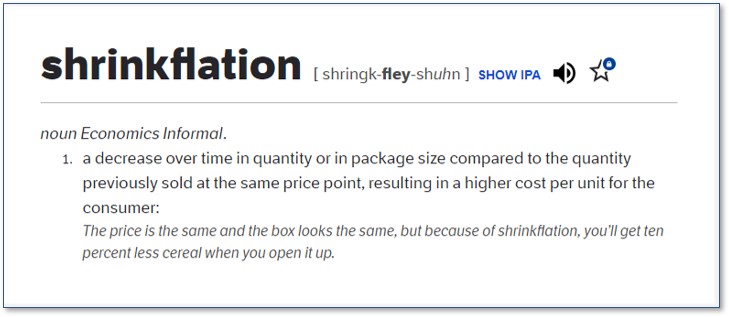

The Elephant with Two Names

That elephant has two names: greedflation and shrinkflation. We know both, although Mr. Powell seems unaware of them. As the old adage states: when the only tool you have is a hammer, every problem is a nail. The Federal Reserve has only one tool to counter inflation: the interest rate. Unfortunately, the linked problems of greedflation and inflation need a different tool altogether.

Professor and former U.S. Secretary of Labor Robert Reich quotes polls that say three in five Americans now call corporate greed a “major cause” of inflation. And why not? During the second and third quarters of 2023, corporate profits drove 53% of inflation. Compare that to the 40 years before the pandemic, when profits drove only 11% of price growth.

Defining the Shrinkflation Problem

Greedflation drives shrinkflation. Companies use shrinkflation to increase profits so they can buy back their stock and goose their already massive executive compensation packages. And because of their unending greed, no amount of money in salary, bonuses, and stock options is ever enough for them.

We see shrinkflation in the supermarket every week. Boxes, bottles, and other packages have grown smaller, thinner, and lighter. Bottles have indents and carve-outs. Bags have been puffed out with air but food starts halfway down. Companies give us less product but charge us the same or even more.

We see shrinkflation in the supermarket every week. Boxes, bottles, and other packages have grown smaller, thinner, and lighter. Bottles have indents and carve-outs. Bags have been puffed out with air but food starts halfway down. Companies give us less product but charge us the same or even more.

In the 60 Minutes interviews, Chairman Powell said, “Those prices don’t come down.” But he didn’t explain why. The word “complacent” came to mind.

Defending Our Budgets

The only defense we have against this greed-driven shrinkage is to stop buying the products. Sometimes, when the product is a nice-to-have, like potato chips or soda, we can do this without a problem. When the product is a must-have, however, such as eggs, we get stuck with trying to find a sale or a store that buys in bulk and passes those lower prices to us.

I have stopped purchasing most breakfast cereals, for example. I take this action not only because the cereal prices have more than doubled, but because I find the slender narrow boxes an insult. They contain about two bowls of cereal (maybe three) at a cost of $2 to $3 a bowl. Sure, eggs are more expensive than they used to be but a dozen eggs give me a lot more breakfasts than that.

Cook from Scratch

A great way to keep expenses in check is to cook from scratch and avoid the processed foods that lend themselves to shrinkflation. A bag of rice costs a lot less than a box of Rice-a-Roni or some other packaged mix. A bag of popcorn that you can make in a pan many times over is much cheaper than buying single-use microwaveable bags. Baking a cake from a recipe will cost you much less than buying a ready-made cake in the store.

A great way to keep expenses in check is to cook from scratch and avoid the processed foods that lend themselves to shrinkflation. A bag of rice costs a lot less than a box of Rice-a-Roni or some other packaged mix. A bag of popcorn that you can make in a pan many times over is much cheaper than buying single-use microwaveable bags. Baking a cake from a recipe will cost you much less than buying a ready-made cake in the store.

As Elizabeth Zott says in Lessons in Chemistry, “We will make dinner and it will matter.” How you make it also matters, however. Cooking isn’t just chemistry: it can also be economics.

Healthier Options

Going back to basics has the added advantage of being healthier because it doesn’t include all the stabilizers, coal-tar dyes, artificial sweeteners, and flavor enhancers of commercial baked goods.

Don’t think of cooking from scratch as more work; think of it as sticking a fork in the eye of the food industry that is squeezing us all every week. Instead of feeling bad because you just can’t afford that item, consider it boycotting the food industry’s overpricing.

Don’t think of cooking from scratch as more work; think of it as sticking a fork in the eye of the food industry that is squeezing us all every week. Instead of feeling bad because you just can’t afford that item, consider it boycotting the food industry’s overpricing.

Just ask yourself, “Do I need this?” Also, “Would my kids be better off not eating this?” To avoid whining and complaints, get them involved in cooking dinner. Show them the price increases and volume decreases, so they can learn and make decisions about what’s really important.

The Cause of Greedflation

So why can companies and their executives get away with this? Well, for one thing, monopolies are fueling greedflation. As Robert Reich says,

“We’re paying a whopping 25% more for groceries than we did in 2019. In 2022 grocery prices rose more than they had in over 4 decades. Inflation is cooling, but the prices keep going up. This is what happens when five companies dominate over 60% of American grocery sales.”

And they will continue to do it as long as they can get away with it. The Federal Reserve’s interest rate has no impact on grocery prices that are rising faster than a popover. All they do is make it more difficult for ordinary families to buy the food they need for their families.

The Power of the Checkout Line

The other thing to keep in mind is that no President—not this one and not his predecessor or any of the others—has the tools needed to stop this upward price spiral. The only ones who do are, well, us.

The other thing to keep in mind is that no President—not this one and not his predecessor or any of the others—has the tools needed to stop this upward price spiral. The only ones who do are, well, us.

We have the power of the checkout line. Whenever possible, just stop buying the expensive products. When companies see their volume dropping quarter over quarter, they’ll get the message. It may take a while but eventually they will figure out that the American consumer has had enough of their greed.

I will end with another Elizabeth Zott quote:

″Whenever you start doubting yourself, whenever you feel afraid, just remember. Courage is the root of change—and change is what we’re chemically designed to do. So when you wake up tomorrow, make this pledge. No more holding yourself back. No more subscribing to others’ opinions of what you can and cannot achieve.”

Together, we can have an impact on food prices. Don’t hold back.