Leave it to an academic to look at the state of the job market and confuse cause with effect. Why am I not surprised? In today’s The Wall Street Journal, Glenn Hubbard asks the question, “Where Have All the Workers Gone?” My first reaction was, “If you have to ask, you just don’t get it.” Then I read the article and confirmed that Mr. Hubbard really doesn’t get it.

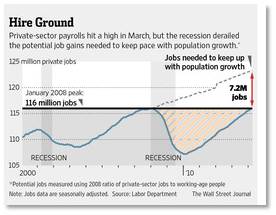

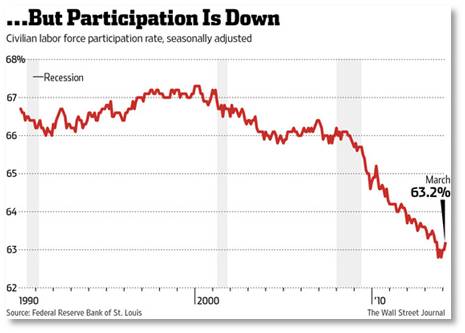

First, he notes “the big puzzle” that looms over the U.S. economy” “only 53.2% of Americans 16 or older are participating in the labor force, which, while up a bit in March, is down substantially since 2000.” I know a lot of people whose response to this would be, “Well, duh.”

Who is Glenn Hubbard? He’s the dean of Columbia Business School, chairman of the Council of Economic Advisors under President George W. Bush and economic advisor to Mitt Romney’s presidential campaign. With Tim Kane he also authored, “Balance: The Economics of Great Powers from Ancient Rome to Modern America,” which will be released in May. Given the sweep of this topic one might expect Mr. Hubbard to have greater perspective on the American economy but his article demonstrates that he is firmly mired in a political point of view.

Today’s @WSJ also includes an article on the current jobs report by Jefferey Sparshott: “U.S. Reaches a Milestone on Lost Jobs,” which further discusses the country’s low labor force “participation rate.”

Today’s @WSJ also includes an article on the current jobs report by Jefferey Sparshott: “U.S. Reaches a Milestone on Lost Jobs,” which further discusses the country’s low labor force “participation rate.”

The Power of Words

Because words have power, I want to address the terms used in these two articles: lost jobs, low participation rate, and poor work incentives.

Lost Jobs: In the Great Recession, jobs were not “lost.” They did not wander off into the wilderness or disappear into a crowd so that employees could not find them. Jobs were cut, slashed, eliminated, wiped out, or demolished. This was done intentionally by senior management to reduce costs, boost efficiency, and improve the bottom line. Sometimes executives took this action to help the company survive, sometimes they were just frightened, and sometimes they did it because everyone else was doing it. Sometimes it was done for reasons, like moving entire departments to another state, that increased expenses but seemed—to someone—like a good idea at the time. But no one dropped these jobs off at the side of the highway so they couldn’t find their way home.

Low Job Participation: Both Mr. Hubbard and Mr. Sparshott seem to believe the employees make capricious choices about whether to keep working or to “drop out” of the work force. As though they have really nothing to gain one way or the other and thus ponder the myriad possibilities. Students may drop out of college because it is their choice to do so but the choice on whether an employee gets to keep his job is up to management, not to him. Thus, the worker does not “drop out;” he’s pushed out. Also, the authors seem to believe that there is no connection between jobs being hacked away from companies like chopping ice off the driveway and low labor force participation. But the two are connected.

Low Job Participation: Both Mr. Hubbard and Mr. Sparshott seem to believe the employees make capricious choices about whether to keep working or to “drop out” of the work force. As though they have really nothing to gain one way or the other and thus ponder the myriad possibilities. Students may drop out of college because it is their choice to do so but the choice on whether an employee gets to keep his job is up to management, not to him. Thus, the worker does not “drop out;” he’s pushed out. Also, the authors seem to believe that there is no connection between jobs being hacked away from companies like chopping ice off the driveway and low labor force participation. But the two are connected.

Poor Work Incentives: Well, if you believe that working or not working is a capricious personal decision then you also believe that people need incentives (usually from the government) to get a job or keep a job. If your basic premise is that people are lazy and prefer not to work, I suppose this all makes sense. To people who live in the real world, who need a paycheck—or a bigger paycheck—this attitude would be a joke if only it were funny.

Where The Workers Have Gone

So where have all the workers gone? Mr. Hubbard finds that they have scurried to three places:

Retirement: He attributes one quarter to one half of the decline in labor force participation since 2008 to retirements. Well, people do tend to retire when they get old and Baby Boomers, like everyone else, get older every year. That does not mean that these folks want to retire or can afford to retire, however. Not everyone has a cushy university salary and tenure to protect it. Not everyone is looking forward to royalties from book sales.

Many people who are 60 and over would love to keep working or need to keep working but, guess what? They were laid off, RIFed, driven out, kicked to the curb, dumped, de-accessioned, pushed out or otherwise told in no uncertain terms that they were no longer either needed or wanted in the work force. This tends to decrease participation, don’t you think?

Poor Work Incentives Created by Public Policies: Really. He really says this. Because we all know that corporations depend on public policies to keep workers coming in every day. It used to be that companies offered good salaries and benefits as incentives for the best, most talented, most experienced workers to walk in the door and stay there. I guess this is old hat.

Poor Work Incentives Created by Public Policies: Really. He really says this. Because we all know that corporations depend on public policies to keep workers coming in every day. It used to be that companies offered good salaries and benefits as incentives for the best, most talented, most experienced workers to walk in the door and stay there. I guess this is old hat.

Now the same companies who embrace the “free market” and who want government to butt out of their business by lowering corporate taxes, slashing regulations, and paying no attention when they offshore their jobs to other countries or pollute the environment in this one now need government to step in and incentivize their workers. Go figure.

Two of the reasons Mr. Hubbard cites for these disincentives are (1) a “greater propensity to seek disability insurance” and (2) extensions of unemployment insurance. While he acknowledges the importance of keeping income support in place, (Phew!), he says that extensions, “also lengthen spells of unemployment, potentially making workers less attractive to employers going forward.” Of disability insurance he says that for some it, “has become an incentive to give up on work.” Note the wording. This is where cause and effect get turned around.

In his mind, people stay on unemployment not because they can’t find a job and like to eat but because unemployment benefits are so generous the recipients would rather just loaf around eating bon-bons and watching soap operas than get a job. People on disability are just looking for an excuse not to work. Again, you hear the belief that people are basically lazy and need to be desperate and starving before they will, grudgingly, accept a job. I am willing to bet that Mr. Hubbard has never collected unemployment insurance at any point in his academic career. Had he done so, he would understand how difficult it is to make ends meet on this fraction of one’s usual income—which is also taxed.

The reality in today’s economy is that people go on unemployment, apply for disability, or retire early to collect Social Security because they can’t find a job and have no alternatives. The cause is lack of jobs, the result is reliance on federal benefits, not the other way around.

Solving the Puzzle

To be fair, Mr. Hubbard does offer suggestions on how to solve the puzzle of low labor-force participation by “easing the return to work.” Again, really. I know many people who don’t need to be eased back into the workforce. They would jump in—tomorrow—with both feet if only they had the opportunity. And, oddly enough for a former member of a Republican administration, most of his solutions involve changes to government policy—and they include raising taxes.

One of his suggestions, is to “encourage low-wage workers” and he would “rethink the federal government’s wider role in the labor market.” Well increasing the minimum wage would serve as a pretty big encouragement. So would increasing hiring so low-wage workers have the opportunity to move to a job that pays a better salary or offers a career track. We don’t need government for that.

And he brings up the ever-popular issue of re-training. Perhaps because I live in Massachusetts, a state with many world-class institutions of higher education, I look askance at this one. Most of the job seekers I know or have encountered have very good educations—and years of experience to back up their degrees.

A Different Perspective

For a different perspective I refer you to Annie Lowrey’s New York Times article, “Out of Work, Out of Benefits and Running Out of Options.” In it you will meet Abe Gorelick who has, “. . . decades of marketing experience, an extensive contact list, an Ivy League undergraduate degree, a master’s in business from the University of Chicago, ideas about how to reach consumers young and old, experience working with businesses from start-ups to huge financial firms and an upbeat, effervescent way about him.” What he has not had for a year—you guessed it—is a job. So what is Mr. Gorelick doing to ease himself back into the workforce? “He is now working three jobs, driving a cab and picking up shifts at Lord & Taylor and Whole Foods.”

This is the face of unemployment that I have seen—not Mr. Hubbard’s view from the ivy-covered towers of Columbia University. I do agree with his assessment that this is a structural problem, not a short-term one. And I also agree that our government and both political parties have been ignoring the issue of long-term unemployment with its attending low labor force participation.

But please don’t tell me that the unemployed are a lazy shiftless lot who need a combination of carrot and stick to drive them back into the work force. We need companies to start hiring. And it’s not the federal government’s fault that they are not doing so.

While you make some legitimate points, I find you just the other side of the same coin about ‘not getting it.’

And it’s not the federal government’s fault that they are not doing so.

Corporations exist on a basic premise – to maximize shareholder wealth. When America has the highest corporate tax rate in the world in conjunction with highest compliance costs, and don’t give me the garbage about Company A or Company B paying little or nothing because most companies large and small pay a gigantic sum of aggregate taxes – especially small businesses, then the federal government is a millstone around free enterprise’s neck and most definitely contributes mightily to our problems.

Do you know about one in nine dollars of GDP in this country goes toward some type of regulatory cost or compliance? Throw in the hidden costs of the abomination called Obamacare with the real push toward single payer and we are talking about exorbitant risk in hiring and uncertainty of future. And you think federal government is conducive to business practice? Are you kidding me?

In addition, the bill of goods solder under the auspices of “higher education” for opportunity is mostly a farce. Only a select handful of majors garnered by “higher education” are useful for most real world practice – the rest an utter waste of time and resource. Our children are being lied to and few parents understand that.

I can fault corporations about many things. Insatiable greed, dishonesty in practice, the pathetic fraternity and sorority management rampant in this country, nepotism, cronyism, age discrimination in hiring, politics of a different color.

I can fault the federal government, especially the current group of small ‘c’ communists currently overseeing this country with a whole bunch more of what ails us.

Your superficial thinking contributes little or nothing to the solution. Not meaning to be hateful – but perhaps a call for you to broaden your horizons.

Tex: You make some excellent points and I agree with you on some of them. Yes, dropping the corporate tax rate would help small and medium-sized businesses. Large corporations, however, have seen record profits in recent years and are sitting on top of pile of money, truckloads of money, mountains of money — but they’re not doing anything with it. Lowering the corporate tax rate won’t change that; it will just let them make even greater profits. It’s only human nature to sit tight when times are uncertain. But companies that are hiding in the dark curled up on top of their profits like Smaug on his hoard may just emerge blinking into the sunlight of better times to find that bolder companies in other countries have taken over their markets.

And what causes the uncertainty? Well, the Great Recession certainly did, along with the $28 billion shutdown of the federal government. Could the current administration have more business-friendly policies? Certainly, and I have felt that way from the beginning but The Next Phase is not a political blog so I have not posted about that. But while we’re on the topic, the GOP-controlled House has spent more time trying to repeal the Affordable Care Act than on drafting bills to help businesses to recover from the recession — so there’s plenty of blame to go around on both sides of the aisle. BTW: I think my horizons are pretty broad. Just look at the variety of topics I deal with on this blog. Thanks for commenting. Tex.

The question should be “where have all the jobs gone”? It seems that no one wants to acknowledge the effects of outsourcing. This IS something that can be changed through policy. simply disincentivize this by raising taxes on business that outsource so it is on their financial interest to keep jobs her e.

Also, increasingly sophisticated software programs are replacing human analytics. I.e. law firms have been bleeding associates who used to review doc production because of predictive coding software… Not much we can do about that.

Then there is the ACA. Contrary to media reports, firms are making the comscious decision to eliminate jobs or cut jours to avoid having to pay the penalties under the law.

Also, we havevthe overleveraged babyboomers that refuse to retire and are causing a back up at the end of the job pipeline

None of these problems are solved by redistributing wealth from those lucky enou gh to have a job

Aetius: I know more “overleveraged” baby boomers who have been out of work for more than two years and can’t find another job because of (A) age discrimination and (B) the reluctance of companies to hire the long-term unemployed. Those baby boomers lucky enough to still have jobs are hanging on to them so as to rebuild their retirement funds as much as possible after impact of the Great Recession. Few people want to work forever — they just want to have a good solid platform to retire on when it happens. And don’t forget, Congress keeps raising the retirement age. That means people have to work longer unless they are wealthy enough to fund a gap between when they retire and when they’re eligible to collect Social Security.

Aline:

We will agree on some things, and disagree on others (and we do need to have a coffee!). Let me proceed systematically.

First, “Lost Jobs.” I heartily agree. I’ll go further. Managers (all the way up) have used the weak economy to keep people captive, getting more and more hours out of them with the “Employment Continuation Award” being dangled as a carrot. As I wrote in my essay about crazybusy, people are working insane hours – for the most part IMHO from fear of what happens if they don’t. “Where there’s a whip, there’s a will” said an orc in The Lord of the Rings. Spot on to today’s employment situation.

“Low Participation Rate”. Again, I agree. I’ve been out a year and a half. And while I’ve enjoyed the blessing of being home for almost every day of my young son’s life… I. Need. A. Job. As do millions of others. Tens of millions. Possibly even 100+ million.

Now, being a free-market kind of guy, I agree that companies’ fiduciary duty is to maximize profits (within the law and ethically). But there also needs to be a human element to this. In the vast majority of cases, people do NOT quit “just because”; they are, as you say, forced out. Whether from downsizing, offshoring, or whatever, there needs to be a capacity to take those people up. When that capacity doesn’t meet the need for jobs, you get swelling unemployment.

There is a political element to this as well. Many articles describe companies being “awash in profits”; company leaders, per USA Today’s recent cover headline, are reaping enormous bonuses. When some “suit” destroys your job and gets rewarded for it, and despite you doing everything you can, you can’t find work… you get angry. You want to punish those who cost you your job. You don’t care about the macroeconomic benefit; you care about your personal economics. Companies that COULD hire, but don’t, because it’s cheaper to push existing workers ever-harder are risking an electoral backlash. And if things get really bad, worse than that.

“Poor Work Incentives”. Well, there are a lot of people who are lazy, and work because they need to, not because they want to. Witness some of the more egregious cases of welfare abuse. But most people WANT to work, WANT to a good job.

So…

“Retirement”. I expect that soon I’ll have to start digging into my retirement funds. Not voluntarily. But I will. And even if I land soon and that action can be avoided, between this period of being “out” and the other ones I’ve been in I, frankly, don’t expect to ever retire if I am able to work. Literally, work until I drop. I have no other choice, and I suspect I’m not alone. To think that people are voluntarily quitting their jobs to enjoy retirement en masse is folly.

I DO want lower corporate taxes here. Companies exist to make a profit and pass it to the owners or the investors. If we lowered corporate taxes to, say, a maximum marginal rate of 10%, we’d see a flood of companies locating here. But by the same token, we need to simplify the tax code to eliminate the crony capitalism that makes it more profitable to buy politicians and special exemptions (paging GE’s billions in profits and zero taxes). I’d be perfectly happy with a one-page corporate tax form: How much profit did you make last year? Send in 10%. Done.

Mr. Hubbard probably has never faced the unemployment line. The pity is that so many managers in companies have not either.

“Incentives”. He does, however, have something of a point at the lower ends of the spectrum. There have been numerous studies showing that, depending on the state where you live and the financial support you receive, you really can live a better life off benefits than by working. It’s not a matter of laziness, it’s a matter of doing the math.

As to the minimum wage: sure, a higher wage creates better incentives to work; however, as I noted, companies exist to earn a profit. Being generous with the resources of others is a poor way to show how generous you are. More, economists like Milton Friedman, Walter Williams, and Thomas Sowell have all argued against minimum wages – and quite convincingly IMHO.

So what’s the solution?

I argued in favor of lower personal taxes in my column:

http://davidhuntpe.wordpress.com/2013/11/03/risk-and-reward/

I claim the same argument holds for corporate taxes. If companies exist to earn and keep profits, lower taxes here than elsewhere would create an incentive to do things here rather than overseas.

I’m going to cop out on other possible solutions – because that’ll make a great column for my own blog!

The real issue, for discussion, is the discrimination against older workers who by enormous preponderance make up the long-term unemployed, and discrimination against people who have been long-term unemployed, period.

Here’s a great piece from Neil Patrick:

http://40pluscareerguru.blogspot.com/2014/04/whats-real-cost-of-ageism.html

Good points, all, David. Thanks for commenting. And check out the other comments that came in over the weekend — along with my replies. I also used a LoTR reference, quite independently of yours. At least we think alike on that subject!

Hubbard is one of many WSJ editorial page contributors who flaunt their disingenuousness. They trot out arguments that make no sense but pander to the (imagined or real?) needs of the advertisers and executives who read the Journal. Few thinking people give credence to the “solutions” proposed by these pundits. However, reading them gives an idea of the kind of propaganda used to further their lust to return to power.